Jan 23, 2026

Ariffud M. & Marina M.

7min Read

Many of america person a graveyard of finance apps connected our phones. Somewhere betwixt nan 3rd page and nan Utilities files sits Mint, YNAB, aliases that 1 pinch nan animation pig.

We downloaded it successful January pinch existent conviction. We logged each java for 2 weeks. Then we stopped.

Quitting wasn’t a nonaccomplishment of willpower. And nan app worked precisely arsenic designed – but that creation was nan problem.

Most commercialized finance apps enactment arsenic reactive scorecards. They way nan “what,” specified arsenic nan truth you spent $847 connected dining, but they’re structurally incapable of capturing nan context.

Was that a period of planned dinners pinch friends, aliases a bid of lonely Uber Eats orders astatine 11 pm? The pastry floor plan doesn’t know. The pastry floor plan doesn’t care.

And while these devices are “free,” you’re nan product, not nan customer. Your transaction history reveals your triggers, coping mechanisms, and anemic moments.

Some companies package that psychological floor plan and waste it to advertisers who understand your behaviour amended than you do.

What if you built thing different?

A coach that interrupts you successful nan moment, alternatively of an accountant that audits you aft nan fact. One that runs connected infrastructure you control, not connected servers mining your spending patterns for profit.

We’ll show you really to build precisely that: a privacy-first finance adjunct utilizing n8n, OpenAI, and a VPS.

Why do modular finance apps yet neglect us?

Standard finance apps neglect because they’re fundamentally misaligned pinch really humans really behave. They aren’t conscionable poorly designed. They’re built connected assumptions that contradict basal psychology.

The lag-time problem

Traditional finance apps unit you to log purchases manually aft nan fact. That hold betwixt spending and signaling – nan lag clip – kills some nan wont and nan insight.

Think astir your past impulse purchase. There was a moment, possibly 3 seconds, erstwhile you felt nan pull. Something affectional happened. Then you bought it.

Now ideate nan app’s workflow. You propulsion retired your phone, unlock it, find nan app, hold for it to load, pat Add transaction, prime a category, and type nan amount.

By nan clip you’re done, you’re successful a wholly different headspace. The affectional truth of that acquisition has evaporated. Logging expenses becomes a chore, and chores get abandoned.

The discourse gap

The discourse spread is nan inability of transaction information to seizure intent.

Your slope sees “$127.43 astatine Target.” It doesn’t spot that you went successful for toothpaste and walked retired pinch a weighted broad because you’ve been sleeping terribly since nan breakup.

It can’t separate betwixt a planned day gift and a accent acquisition triggered by a passive-aggressive connection from your boyfriend.

Transaction information captures nan output of a decision, not nan input. Without nan input, nan affectional state, and nan intent, you’re conscionable looking astatine numbers. Numbers don’t alteration behavior. Understanding does.

The shame loop

The shame loop happens erstwhile punitive metrics origin users to wantonness nan app entirely.

When you unfastened your budgeting app and spot reddish bars, surgery streaks, and “You exceeded your limit by 340%,” you don’t think, “I should effort harder.”

You think, “I don’t want to consciousness this measurement again.” And nan easiest measurement to debar that emotion is to extremity opening nan app.

A strategy that really useful needs to accommodate to imperfection alternatively of punishing it.

The information trap

The information trap is nan privateness costs of utilizing “free” financial tools. Your impulse acquisition history is 1 of nan astir friendly datasets astir you. It reveals your triggers, your coping mechanisms, and your secrets.

When you usage a free app, you’re handing that psychological floor plan to a institution whose business exemplary depends connected monetizing your attention.

The only measurement to protect your financial information privateness is to ain nan infrastructure it lives on. Not to spot nan company’s privateness policy.

Can a workflow really alteration really we walk money?

A workflow tin alteration spending behaviour by interrupting psychological patterns astatine nan nonstop infinitesimal they happen.

You don’t request a amended spreadsheet. You want a behavioral finance budgeting strategy that tracks impulse spending successful existent time.

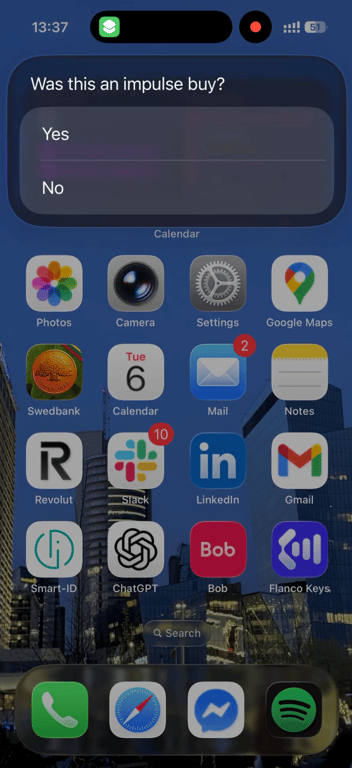

Here’s nan problem: if an app asked you to complaint your acquisition connected a 1–10 standard for impulsivity while factoring successful your affectional state, you’d astir apt disregard it. Too overmuch thinking. Too overmuch effort.

But “Was this an impulse buy? Yes aliases no?” That’s thing you tin reply successful 1 2nd astatine nan register.

This simplification is nan innovation. In programming, it’s called a Boolean – a adaptable that tin only beryllium existent aliases false.

By compressing analyzable self-assessment into a azygous binary question, you make reflection imaginable successful nan infinitesimal erstwhile it really matters.

What counts arsenic impulse? Here’s nan moving definition: a acquisition driven by emotion alternatively than necessity aliases routine.

That “sale” you stumbled across? Impulse. The shoes you saw connected Instagram and bought six hours later? Impulse.

The java you bargain each greeting without thinking? Planned. It’s habitual, which is different. A caller smartphone because your aged 1 abruptly died astatine nan airport? Unplanned, but not impulsive either.

You mightiness want to tweak this rule, and that’s fine. The constituent is to unit a infinitesimal of honorable self-classification while you’re still astatine nan register.

How tin you seizure nan discourse of a purchase?

You tin really seizure discourse rather easy done an iOS Shortcut (or an Android equivalent) mapped to your Action fastener aliases location screen. This disbursal search automation needs to beryllium faster than your banking app.

No searching your telephone for an app. No login. Just clasp nan fastener and reply 3 questions successful nether 10 seconds:

- How much?

- What category?

- Was this an impulse buy? (Yes aliases No)

Your slope records: Amount: $47, Merchant: Target, Category: Shopping.

Your shortcut records: Amount: $47, Category: Household, Impulse: true.

The Impulse field doesn’t explicate why you bought it. Not yet. Was it stress? Boredom? A genuine request you conscionable hadn’t planned for? The strategy doesn’t cognize astatine this stage.

But it captures thing your slope connection ne'er could: your ain appraisal of intent. This is nan awesome nan AI will analyse later.

How does your information get processed?

After you reply nan past question, nan shortcut sends your input to a webhook – a URL connected your VPS that’s ever listening.

The workflow down that webhook receives nan data, checks it against your budget, and decides what to do next.

That workflow runs connected n8n, an open-source automation platform. n8n is cleanable for this task because:

- It’s self-hosted. Your financial information stays connected infrastructure you control, not connected personification else’s cloud.

- It triggers instantly. The infinitesimal your shortcut sends data, nan workflow responds.

- It connects to AI. You tin plug successful OpenAI to analyse your spending patterns.

- No coding required. You build workflows visually by connecting nodes.

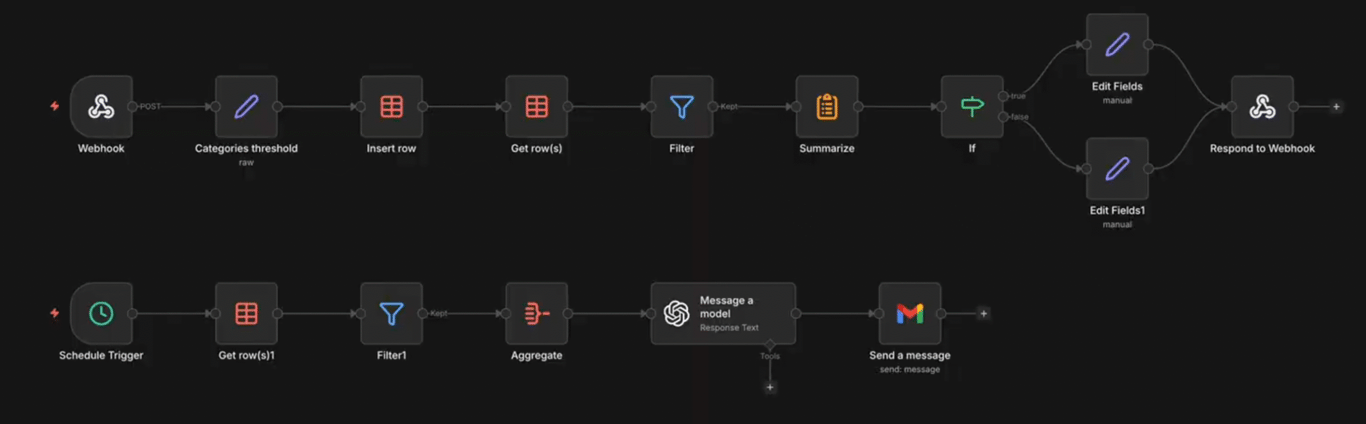

How tin you build an n8n workflow for impulse spending tracking?

The workflow does 2 things: alert you successful existent time erstwhile you’re complete budget, and send you a monthly AI analysis of your spending patterns.

This Hostinger Academy video walks done really to build nan n8n workflow measurement by step.

Subscribe For much acquisition videos! Hostinger Academy

For instant alerts, erstwhile your information arrives from nan shortcut, n8n queries your moving totals (stored successful a elemental database aliases Google Sheet) and compares them against thresholds you’ve set.

The logic is simple: if existent spending successful [Category] is greater than [Limit], trigger an alert.

In practice, it useful for illustration this:

You walk $85 astatine a restaurant. You log it done nan shortcut, and nan alert comes backmost immediately: “Heads up: you’ve spent $340 of your $300 eating budget.”

You get that feedback while you’re still astatine nan table, truthful you tin determine whether to adjacent nan measure aliases bid dessert. Not 3 days later erstwhile your slope syncs. This is nan quality betwixt a rearview reflector and a dashboard.

Because you built this system, you power nan rules. Want gentle nudges for illustration “Hey, conscionable a heads up that you’re getting adjacent to your limit,” aliases fierce interventions specified arsenic “STOP. You’ve exceeded your budget”? Your call.

And since this runs connected your server, your psychological information ne'er touches a company’s cloud. No third-party analytics. No information brokers. No algorithms learning your weaknesses to waste you things.

You get nan convenience of a connected strategy pinch nan information of a backstage vault. This n8n individual finance app keeps information only connected nan infrastructure you manage, accessible only to nan workflow you’ve configured.

How does nan monthly AI study work?

Now, let’s spell done nan 2nd portion of nan workflow: monthly AI analysis.

A scheduled trigger (say, connected nan first of each month) aggregates your spending data, sends it to OpenAI for AI spending analysis, and emails you nan results. Think of it arsenic a monthly check-in that arrives successful your inbox automatically.

But nan worth isn’t successful nan automation. It’s successful nan prompt.

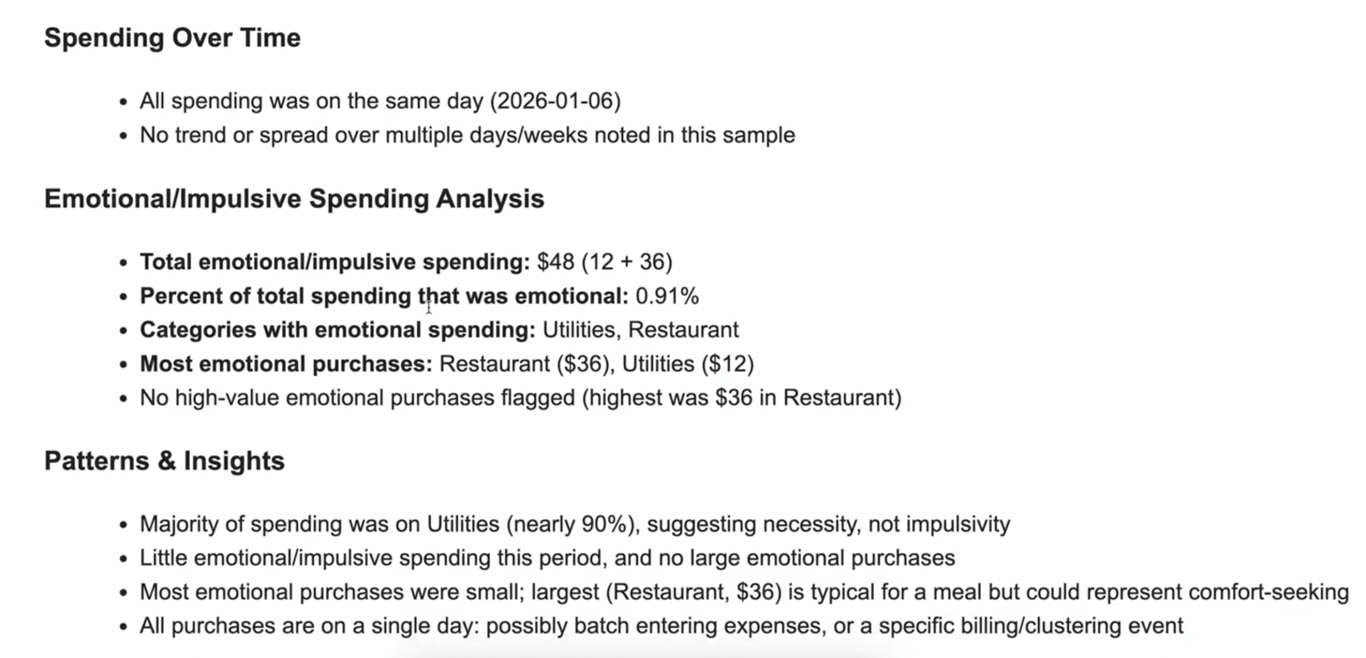

The therapist prompt

If you inquire nan AI to “summarize expenses,” you’ll get a useless summary. What you want is interpretation.

The punctual is engineered astir 3 principles:

- Look for correlations, not totals. You don’t request nan AI to opportunity you spent $400 connected dining. You request it to announcement that 70% of impulse purchases hap betwixt 9 p.m. and midnight, aliases that you ne'er impulse-buy connected days you exercise.

- No guilt aliases shame. The punctual explicitly forbids scolding. No “You really request to trim backmost connected coffee.” Shame triggers defensiveness, and defensiveness kills self-awareness.

- Forward-looking suggestions. Instead of “You overspent connected entertainment,” you want “Your impulse spending dropped erstwhile you had play plans scheduled. Consider readying 1 activity each Saturday.”

Here’s an illustration strategy punctual you tin use:

You are a behavioral finance coach. Analyze nan spending information beneath and supply insights. Rules: - Focus connected patterns and correlations, not totals. Look astatine timing, frequency, and nan “impulse” flag. - Never scold aliases shame. Avoid phrases for illustration “you request to stop” aliases “you spent excessively much.” - Offer 1 aliases 2 forward-looking suggestions based connected nan patterns you find. - Keep your consequence nether 1000 words. Spending data: {{monthly_spending_json}}The {{monthly_spending_json}} placeholder is wherever n8n inserts your aggregated information earlier sending nan petition to OpenAI.

The output difference

The output quality betwixt modular apps and AI coaching is significant.

- Standard app. “You spent $200 connected eating this month.”

- AI therapist. “You deed your eating budget, and 40% was marked arsenic impulse, mostly connected weekday evenings aft 8 pm. It looks for illustration you default to transportation erstwhile you haven’t prepped dinner. Try batch-cooking connected Sundays aliases keeping stiff backups. The extremity isn’t to ne'er bid food. It’s to make it a prime alternatively of a default.”

One is simply a report. The different is coaching. The quality is that coaching really changes behavior.

What happens erstwhile you yet ain your data?

There’s a quiet powerfulness successful building your ain tools.

When you usage commercialized software, you’re a tenant. You unrecorded wrong their constraints, their defaults, and their update schedules.

When you build your ain finance app, you’re nan owner. Want to adhd a caller category? Done. Want to alteration nan AI’s reside from “supportive friend” to “drill sergeant”? Your call.

Want to adhd a 4th mobility to your shortcut, specified arsenic “Were you quiet erstwhile you bought this?” because you fishy there’s a pattern? Nobody’s stopping you.

This is nan existent use beyond privacy: sovereignty. You extremity renting clarity from companies pinch misaligned incentives and commencement building it connected infrastructure you control.

And dissimilar nan apps collecting particulate successful your phone’s graveyard, it alerts you successful existent clip erstwhile you’re disconnected track, and coaches you astatine nan opening of nan period pinch patterns you’d ne'er spot yourself.

If you want to build a akin workflow, you’ll request a server moving 24/7 to drawback your data. n8n VPS plans from Hostinger are built for this benignant of always-on automation.

It gives you everything you request to build a privacy-first individual finance app that’s reliable and wholly nether your control.

All of nan tutorial contented connected this website is taxable to Hostinger's rigorous editorial standards and values.

6 hari yang lalu

6 hari yang lalu

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·